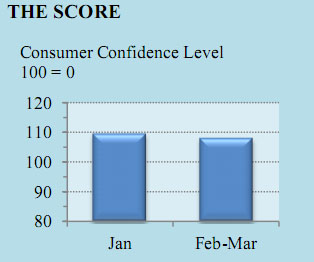

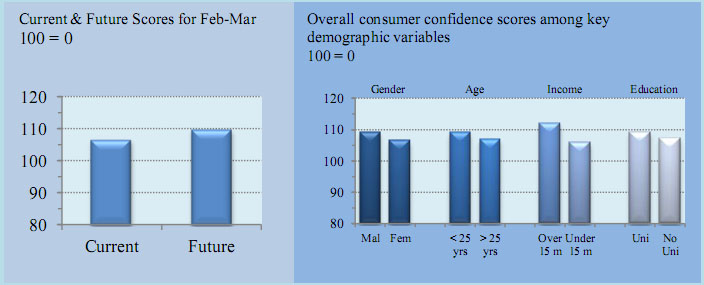

- The overall confidence score decreased 1.5 points from its pre-Tet level of 109.5 to 108.

- The main difference is the lower future score down from its pre holiday high of 115 points in January to 109.6 points in the Feb/Mar survey.

That young Vietnamese consumers have a strong confidence level is good news for an economy with a growth rate of 5%, for the first quarter of 2014. This is a rather healthy growth rate, one which many countries would envy, but it is down from 6% from the previous quarter at the end of 2013.

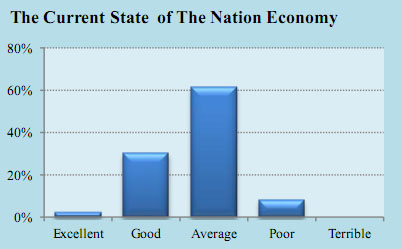

Every month in our survey we ask young consumers a number of questions about their views of the national economy.

Their response illustrates how perceptive young people are about the economy. Young people understand the economy is not great, but they are optimistic about their future and that of the national economy.

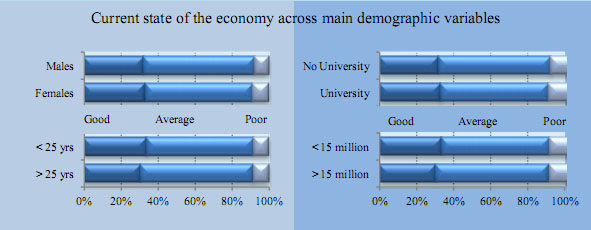

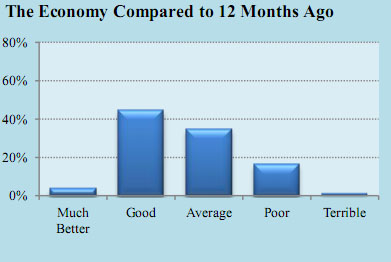

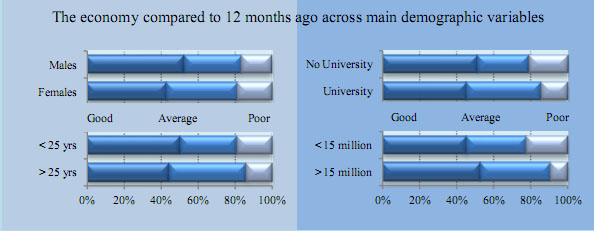

Young consumers are by nature optimistic, yet they are of the opinion that the current economic situation is only average. At the same time they believe that the national

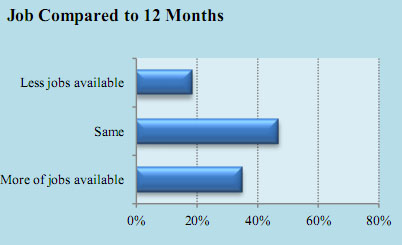

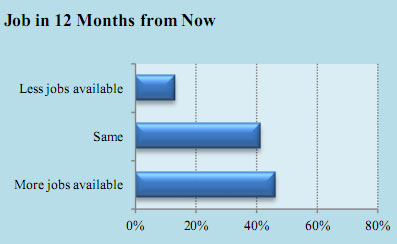

economy is in better shape than 12 months ago and overwhelmingly they expect that the economy will continue to improve over the next year.

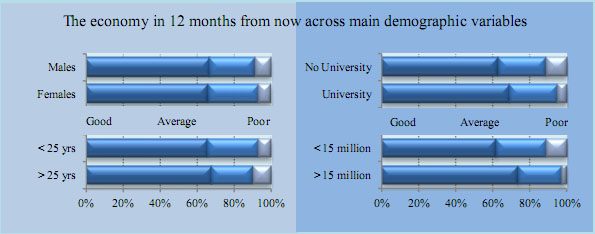

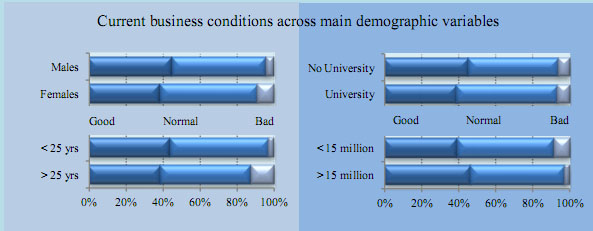

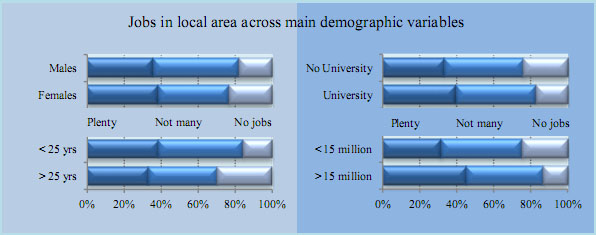

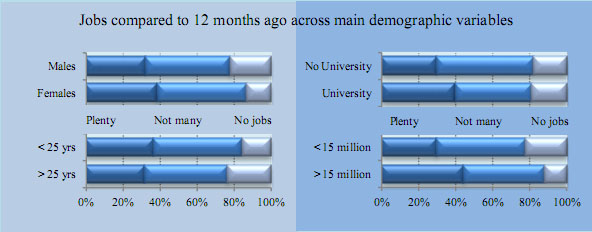

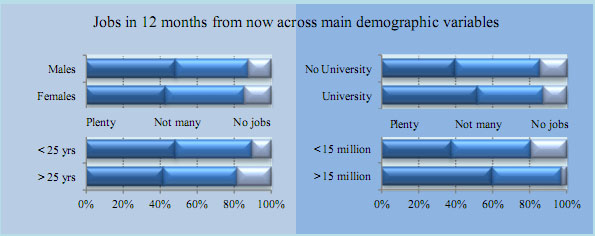

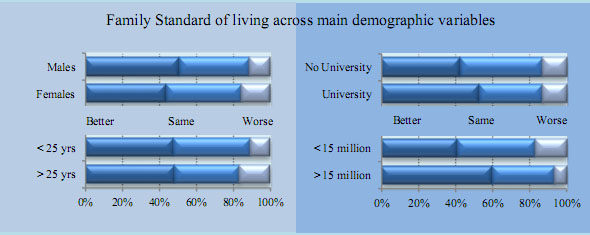

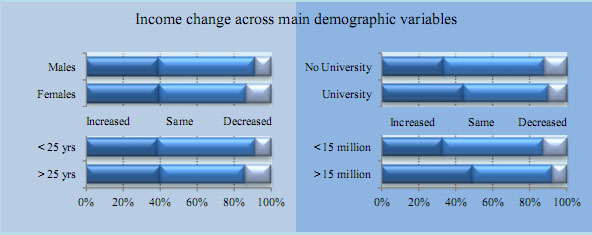

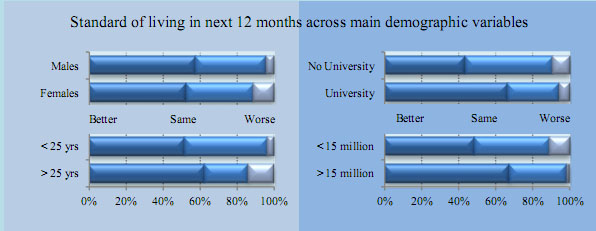

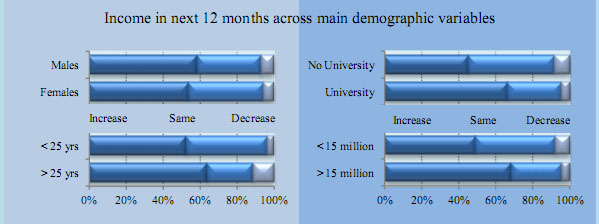

There are some differences in of opinion; most noticeably young consumers with a university degree and those from households with higher income have a significantly more positive expectation about the economy for the next 12 months. As expected this correlation between household income and education indicates that for young Vietnamese a tertiary degree opens the doors to the job market.

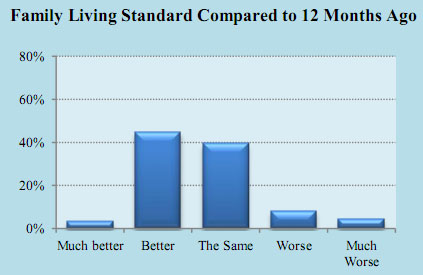

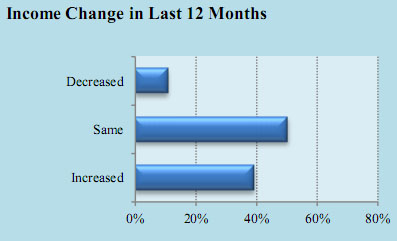

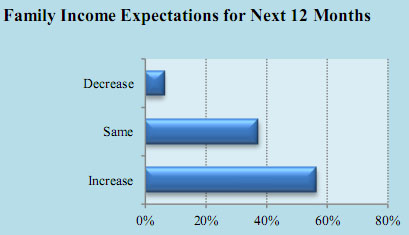

Indeed most respondents are quite optimistic about their career and income prospects for the next year, leading to a direct positive impact on the living standards of their families.

- The Young Consumer Confidence is on very healthy levels with a score of 108 overall.

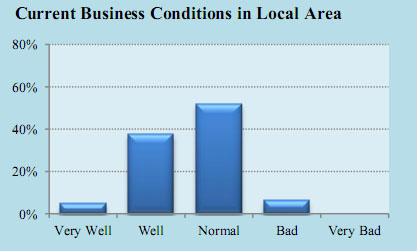

- The national economy is in average shape, but consumers say it is improving.

- The overall outlook for the next 12 months is very positive with consumers expecting more jobs and higher incomes.

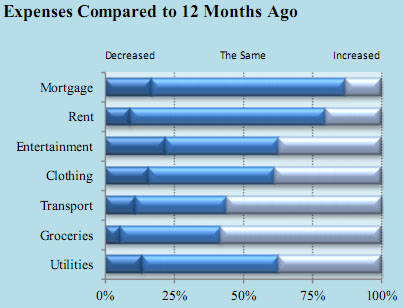

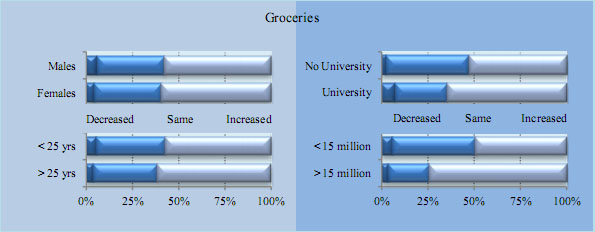

- The Cost of groceries is the biggest concern for young consumers followed closely by transport costs.

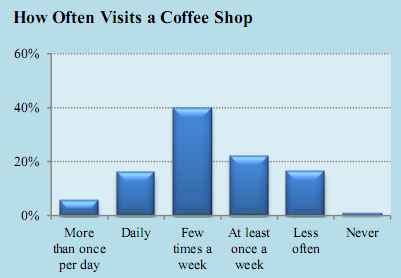

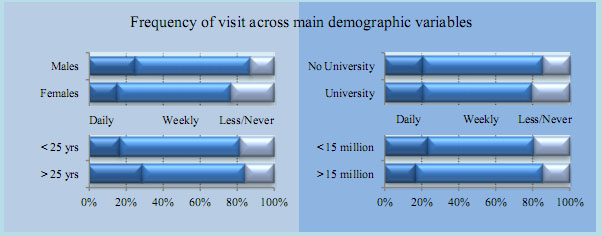

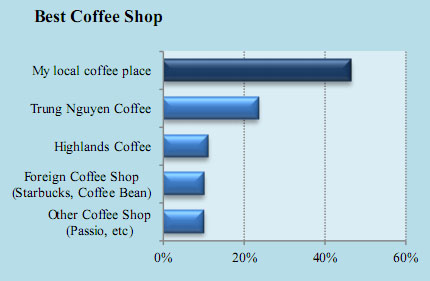

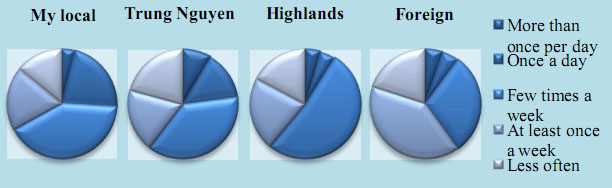

- Young consumers love coffee and they select which coffee shops to visit based mainly on the price and the coffee quality.

The Score . . . . . . . . . . . . . . . . . . . 1

Respondent Profile. . . . . . . . . . . . . . . 2

The National Economy . . . . . . . . . . . . . .2

Business and Eemployment . . . . . . . . . . . .3

Family Finances . . . . . . . . . . . . . . . . 4

Spotlight Question – Coffee Shops . . . . . . . 6

Thuy comes from Phu Xuyen, from what used to be known as Ha Tay Province, now part of the Hanoi Municipality. Her mother works making handicrafts, but Thuy doesn’t need her help. She does some shift work at a KFC restaurant for 6-7 hours each time and earns enough to live while she studies. As she looks forward to her future she wonders if she will work in an area related to her Major, ‘I have taken part in many workshops, but things are not great so I might have to work in the food or entertainment industry for a bit longer’.

Similar to many young people her age, she dreams of travelling and seeing the world, but she would like to see her own country first, ‘I would like to travel with my friends to the mountain areas of Vietnam and experience life in a different way’. She also enjoys coffee with friends, but that’s something she can only afford a couple of times a week. Her favorite place is the local coffee shop at her school; it caters for students and to her taste, ‘is the place I like and I can afford’.

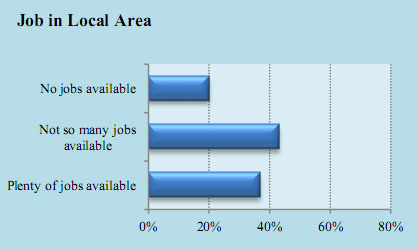

Despite all these concerns, young consumers remain positive about their employment prospects. Only about 6% of respondents think that current business conditions are bad and about 37% think that there are plenty of jobs available at the moment.

In this month’s spotlight question we asked about the coffee habits of young consumers, mainly about the shops they visit and why.

Tiếng Việt

Tiếng Việt.png) English

English

.png)