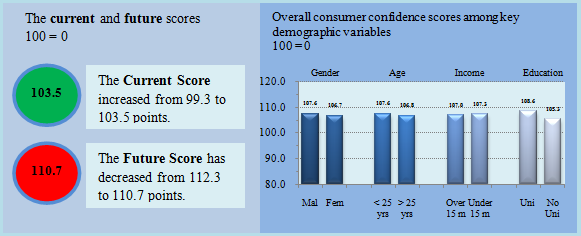

- The overall confidence score increased 1.3 points from the previous score of 105.8 in April to 107.1 in May.

- The increase was due to an improvement in the score respondents gave to the current state of the economy from 99.3 to 103.5 points.

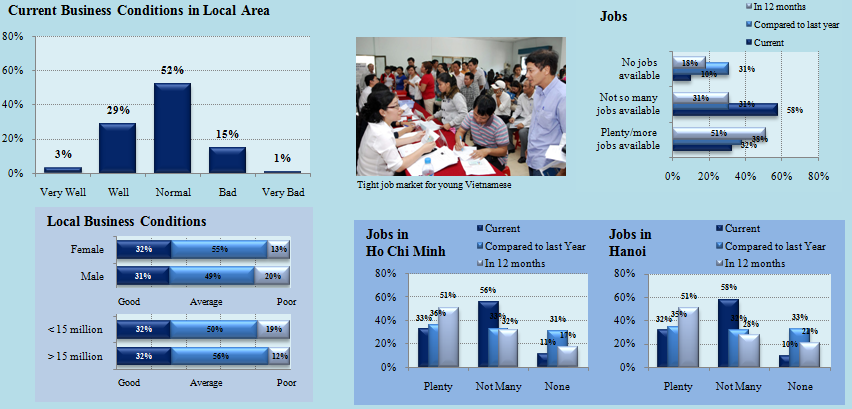

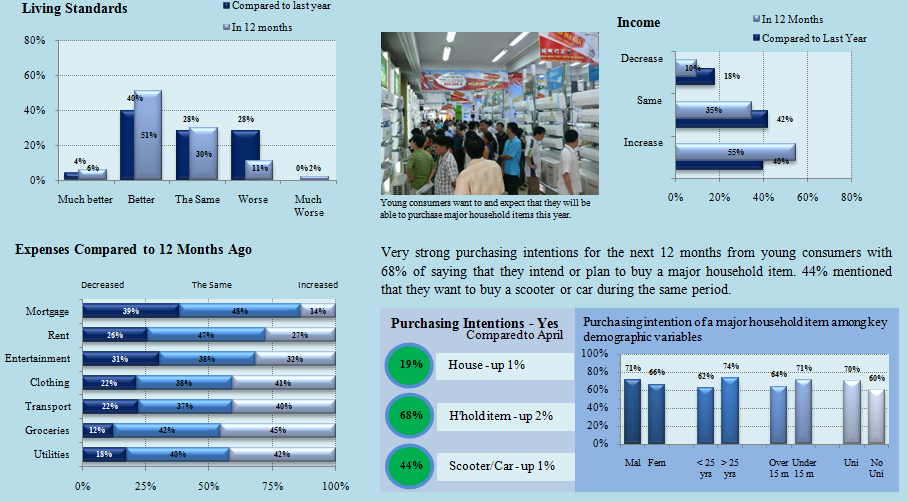

higher incomes and living standards. The survey shows that young consumers remain very optimistic and they want a better life in the next 12 months.

It is important to remember that the survey is conducted online and as such it does not represent the whole country. This survey is representative of the young, urban and online active population of Vietnam. The May survey was completed by 300 respondents and the confidence scores were calculated based on eight questions which are given equal weight. These questions are about their view of the national economy, local business conditions, job availability and spending expectations. Four of the questions are about the current situation and the other 4 about their future expectations and from that we arrive to an overall consumer confidence score.

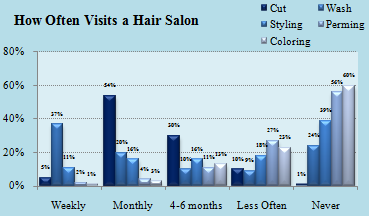

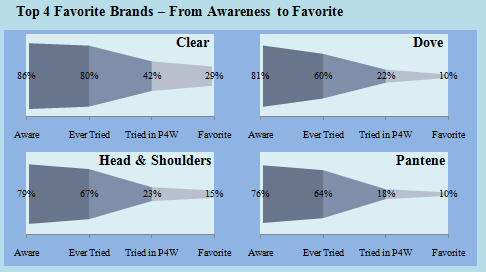

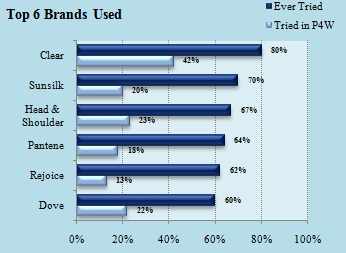

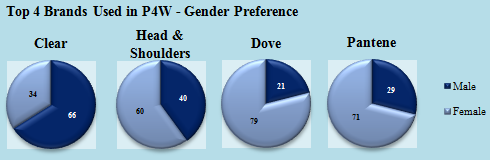

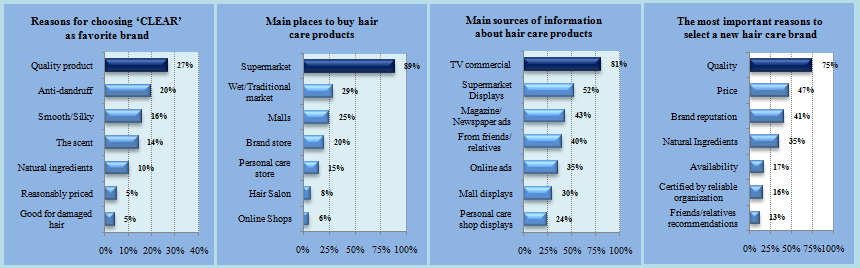

Also each month we include a special set of questions (Spotlight) focused on Brand awareness and usage. For this month we wanted to explore the market for hair products. In particular we wanted to know the brands young Vietnamese consumers prefer and why. So we asked some general questions about brand awareness, trial, preference, sources of information, and reasons for choice.

The results show that consumers are aware of the choices they have and the quality of that product is the main factor in choosing a brand together with a good price and the right brand reputation. Young Vietnamese consumers try and use many brands, so new brands can succeed in this market as long as brand awareness is well developed, the price is good and the quality satisfies the needs of these demanding consumers.

- Young Vietnamese consumers remain very confident with an overall score of 107.1.

- The current shape of the national economy is better compared to the April survey, increasing from 99.3 to 103.5 points.

- A very positive outlook for the next 12 months even with a decrease in the future score from 112.3 to 110.7 points

- The cost of groceries remains the main concern of young consumers, followed closely by the increase in the cost of clothing and transport.

- Young Vietnamese consumers love their hair products and their main preference is CLEAR.

The Score. . . . . . . . . . . . . . . . . . . .1

Respondent Profile. . . . . . . . . . . . . . . 2

The National Economy . . . . . . . . . . .2

Business and Employment . . . . . . . . . . . .3

Family Finances. . . . . . . . . . . . . . 3

Spotlight Question – Hair Products. . . .4

Our respondent profile for May is Trieu Tu Dung, a 25-year-old accountant from Can Tho. Dung has worked for a building materials company for 3 years, ever since she completed her accounting college degree in 2011. She got married to a colleague from the sales department and now they have a cute 18-month old boy. Together they earn $650 a month which is considered a high salary for a tier 2 city like Can Tho, yet Dung is currently not optimistic about current national economy "I'm worried about the economy going down due to the current issues that have happened in some industrial zones (related to the South China Sea dispute between Vietnam and China), this could lead to more unemployment, less jobs available, higher prices and lower living standards".

Currently Dung and her husband are trying to save enough to buy a piece of land in which they can build a boarding house. She said that "we will still go to work like we do now, but at the same time we will have the boarding house and the money we get from that we can save for our son's future". They place high hopes on their future life, "our life will be better as we are working hard and learning at the same time to get promotion in order to earn more in the future".

One of Dung's interests is to go shopping during weekends with either her friends or her family. She normally goes to a hair salon once every 2 weeks for manicure, hair wash or face massage. She also has her hair straightened or dyed every month. Her favorite hair care brand is L'Oreal, "it has a pleasant scent; the dye shows the color easily and it doesn't fade; it makes my hair smooth and shiny and the prices are acceptable, it's not low but reasonable to me". Dung often buys hair products in hair care stores, and seeks advice or information about hair care from her friends, colleagues and sellers as well. The most important thing that Dung will take into consideration when she buys a new hair care product is the price. The next two important things that will influence her decision are brand reputation and product quality. "I care that the product will make my hair smooth and shiny. Also that the color will be long lasting and that it has a pleasant scent".

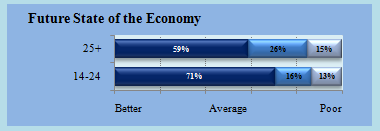

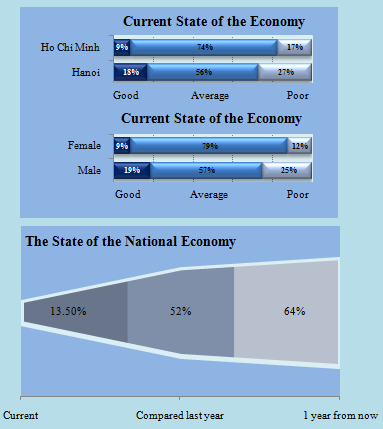

Young consumers rate the National Economy as average with about 86% of respondents' rating the economy as average of poor, though at the same time they say that it is in better shape than the previous year. Still Survey respondents remain highly optimistic for the coming year with an overwhelming majority expecting that the National Economy to be better or much better in 12 months from now.

Tiếng Việt

Tiếng Việt.png) English

English

.png)