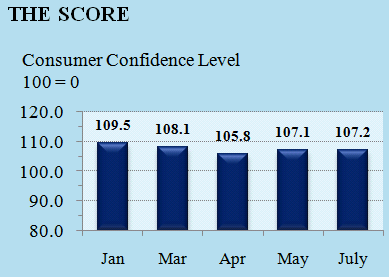

- The Overall confidence score remains virtually unchanged with a 0.12 point increase compared to May.

- Consumer confidence has remained very healthy for the past five surveys and shows the optimism of young Vietnamese consumers.

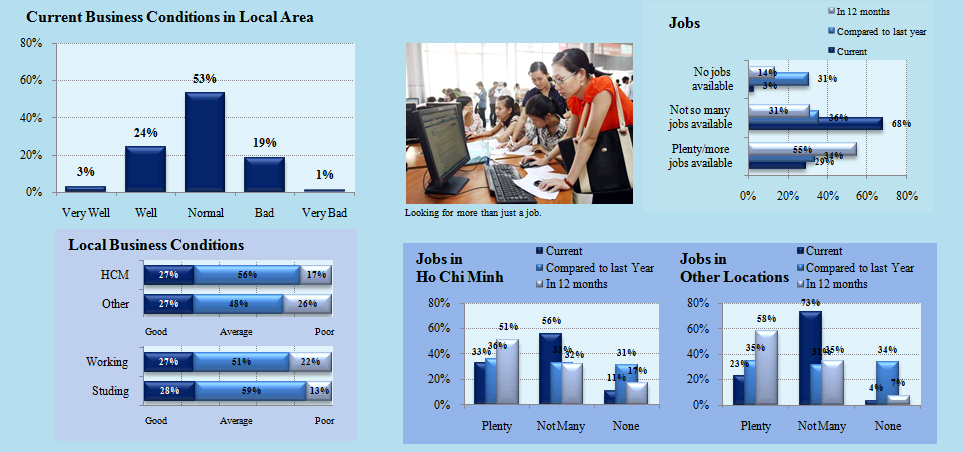

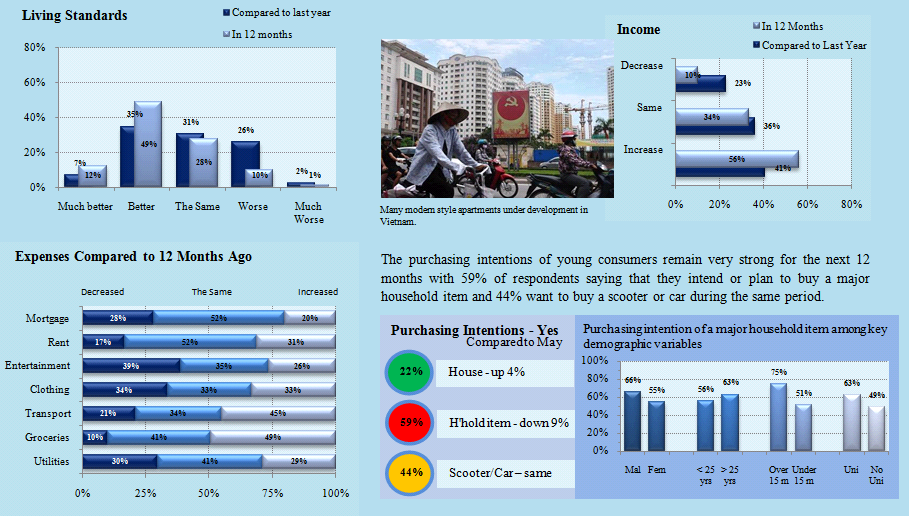

the economy, which is not great, but at the same time there is a general air of positive expectations for the next 12 months. Survey respondents shared a view of hope for better living conditions, higher incomes and more jobs. In summary, young consumers remain very optimistic and they expect vast improvements in the next year.

Over the year a trend of high confidence has emerged where young consumers seem to be always positive about the future outlook of the economy. A question arises however; is this true confidence or is it just some form of blind optimistic (overconfident) hope? Regardless of the answer the trend demonstrates the underlying positive nature and perspective of Vietnamese consumers; they want, aspire and work relentlessly for a better future for themselves, their families and their country.

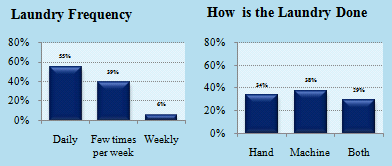

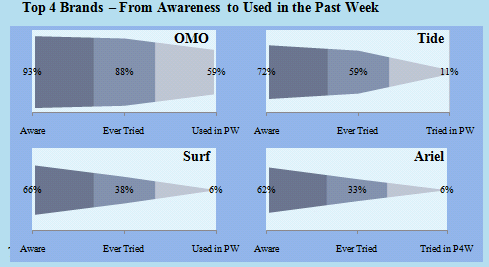

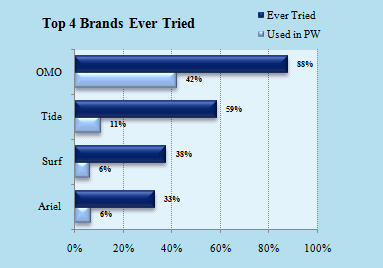

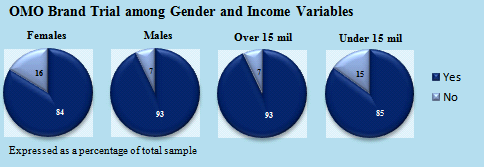

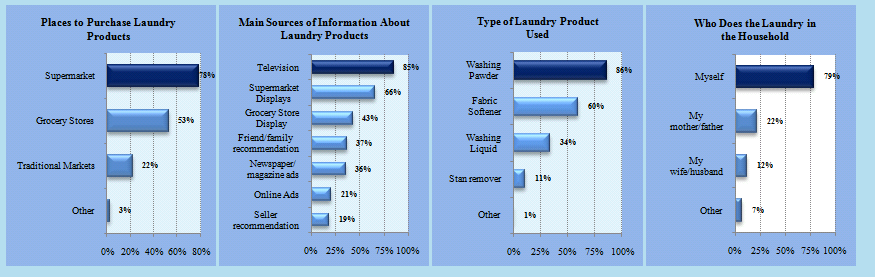

For July the focus of the Spotlight Questions was brand awareness and usage of laundry products. We wanted to explore the market for laundry products; in particular we wanted to know the brands young Vietnamese consumers prefer. So we asked some general questions about brand awareness, trial, recent use as well as sources of information and influence on laundry detergent choice.

Vietnamese consumers are spoilt for choice when it comes to selecting laundry products with OMO and Tide on top the market. Vietnamese consumers in general are very demanding and brand conscious, and it is foreign laundry brands that tend to satisfy this demanding character far better than local brands mainly due to their strong marketing and constant innovation and development of their products.

- Young Vietnamese consumers remain very confident with an overall score of 107.2 points.

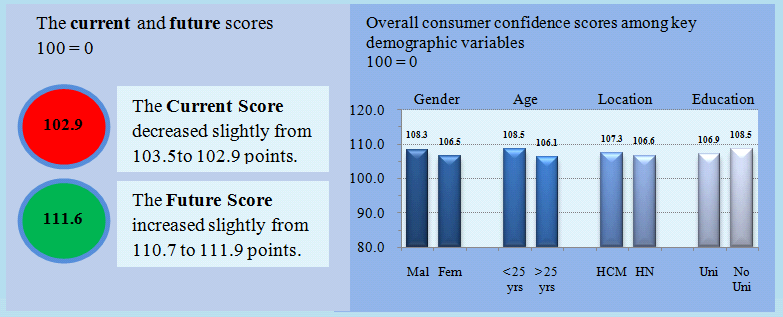

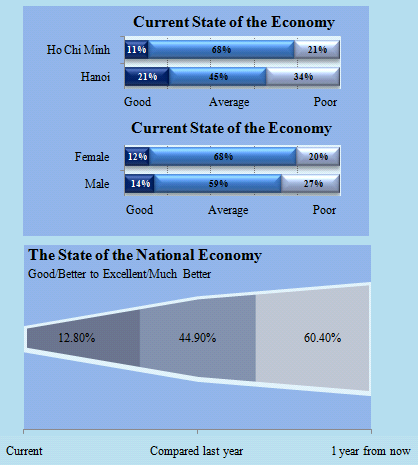

- The current shape of the national economy remains positive even after a slight decrease compared to May.

- A strong outlook for the next 12 months even with the future score increasing slightly from 110.7 to 111.9 points

- 22% of households intends (maybe just hope) to buy a house in the next year.

- OMO is the best known and most used laundry product brand with 59% of respondents saying they used that brand in the past week.

The Score. . . . . . . . . . . . . . . . . . . .1

Respondent Profile. . . . . . . . . . . . . . . 2

The National Economy . . . . . . . . . . .2

Business and Employment . . . . . . . . . . . .3

Family Finances. . . . . . . . . . . . . . 3

Spotlight Question – Hair Products. . . .4

Our respondent profile for June-July is Tran Nguyen Ngoc Tuyen, a 25 year old Real Estate agent from Ho Chi Minh City. Tuyen graduated with a Finance degree from the HCM University of Economics and at that time she tried to find a job that matched her studies. Her first job after university was as a sales manager for a fashion company, but then she changed her job to work as a Real Estate agent. Tuyen is still single and rents a small apartment which she shares with her brother who is studying at university. She earns over $600 per month and with this salary she can cover for all expenses, but she is a thoughtful person and she is always looking for ways to save money “we don’t know what will happen tomorrow, so having savings in the bank helps me feel more comfortable”.

Another important reason for Tuyen to save money is to start her own business in her hometown in Tien Giang province which is about a 2 hour drive from HCM. She thinks of a business because “the economy in my hometown is currently growing so there is potential for me to run my own business”. When asked about the National Economy Tuyen is very optimistic, “the economy has been recovering during the first haft of the year, especially in real estate’. Tuyen points out that the Real Estate market has had lots of transactions compared to the same time last year, ‘there is strong interest in buying houses for investment, which to me means that people also believe in the future of the national economy and because of that I believe that the economy will be in a stronger position at the end of this year.”

Although she shares her apartment, it is Tuyen who is responsible and takes care of the household including doing the laundry, cooking, cleaning and shopping. She normally does the washing 2 or 3 times a week using OMO washing powder. She has used this product for a very long time, so when thinking about buying detergent she will immediately think of buying OMO. When asked to explain why, she says “my mom used this washing powder, so it became a habit for me’, but Tuyen also agrees that the brand has a strong advertising presence and that it has many promotions which influences her purchasing intentions.

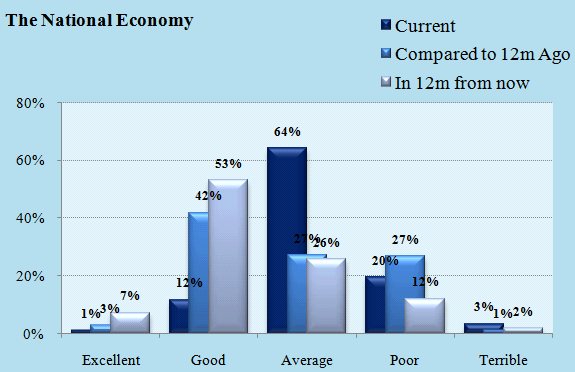

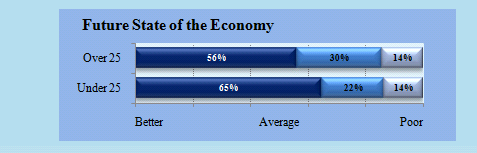

Young consumers are critical of the current the National Economy with about 87% of respondents’ rating the economy as average of poor. Although their current view of the economy is not very positive, some 45% of respondents say that it is better or much better compared to 12 months ago and an overwhelming 60% expect improvements in the National Economy in 12 months from now.

Tiếng Việt

Tiếng Việt.png) English

English

.png)