Vietnam Young Consumer Confidence Report

Consumer confidence surveys are important pieces of economic information that broadly measure the public confidence in the economy as well as the expectations of income and personal/family wealth growth. The purpose of this Young Consumer Confidence Survey is to provide information about the current and future path of household spending. More specifically we aim at providing information that relates to the younger, urban, online savvy population of Vietnam.

This information is important, Vietnam continues to reaffirm its commitment to modernize and it is actively working to create the employment conditions that satisfy the needs of its ever growing labor force, a young labor force. It is estimated that about one million young Vietnamese people enter the workforce every year.

We do not claim that our Young Consumer Confidence Report represents the country as a whole, but it represents a young and urban population with online access.

We must point out that our Young Consumer Confidence Survey is based on a sample size of 300 respondents. This sample size is small and as such there is a negative impact on the sampling error. It also means that the statistical confidence interval is greater for the estimated Confidence Scores. Also important to mention is that the sample is taken from an online panel and as such it is only representative of that panel. A representative sample would require for all people in the target population to have an equally known probability of selection for the survey.

We do not claim that our Young Consumer Confidence Report represents the country as a whole, but it represents a young and urban population with online access.

We must point out that our Young Consumer Confidence Survey is based on a sample size of 300 respondents. This sample size is small and as such there is a negative impact on the sampling error. It also means that the statistical confidence interval is greater for the estimated Confidence Scores. Also important to mention is that the sample is taken from an online panel and as such it is only representative of that panel. A representative sample would require for all people in the target population to have an equally known probability of selection for the survey.

Regardless of the limitations which are often pointed of these types of reports, we expect respondents to be aware of their own situation and as such the survey results reflect the present economic situation as well as show their confidence of their spending over the next period.

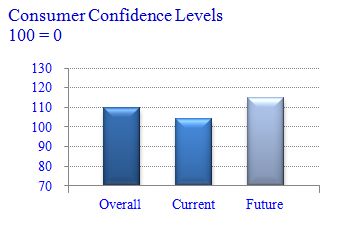

We have based our overall consumer confidence score on eight questions that are part of the survey and each of the questions is given equal weight in the overall score. In addition to the overall index, we can report on two individual ratings, the present situation and future expectations over the next 12 months. In evaluating the present situation we ask respondent to rate the present economic conditions. This includes asking respondents to evaluate the current business situation and job availability in their local area, as well as a look at the national economy. In terms of their expectations, the rating is based on how they see the national economy, local business conditions, and expected job availability over the next 12 months.

We have based our overall consumer confidence score on eight questions that are part of the survey and each of the questions is given equal weight in the overall score. In addition to the overall index, we can report on two individual ratings, the present situation and future expectations over the next 12 months. In evaluating the present situation we ask respondent to rate the present economic conditions. This includes asking respondents to evaluate the current business situation and job availability in their local area, as well as a look at the national economy. In terms of their expectations, the rating is based on how they see the national economy, local business conditions, and expected job availability over the next 12 months.

THE TAKE AWAY

- The Young Consumer Confidence is on very healthy levels with a score of 109.5 overall.

- Young confidence on the future is highly positive, the future score for the week before Lunar New Year was 115.

- The general perception of the National Economic situation is that it has improved over the last 12 months.

- 70% of respondents reported ‘no or not so many jobs available’ in their local area.

- For all their optimism, young consumers are feeling the pressure of an increase in the cost of living; they are especially sensitive about price increases to rent, transport and entertainment.

- VietcomBank leads on young consumer awareness, and when it comes to selecting a bank, is all about their reputation.

THE NATIONAL ECONOMY

The state of the National Economy is average.

- Younger respondents aged less than 25 years are more positive about the current state of the National Economy with 29% saying it was good or very good compared to 21% of those aged 25+.

- 31% of males think that the current state of the National Economy is good or very good compared to 22% of females.

- Interestingly a higher proportion of respondents without a university education are more positive about the state of the National Economy compared to those with a university or post-graduate degree.

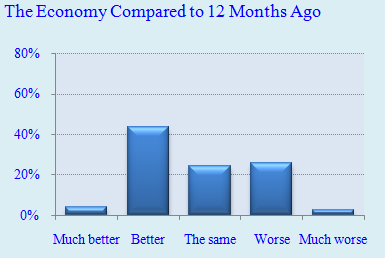

The National Economy has improved over the last 12 months.

- The general perception of the National Economic situation is that it has improved over the last 12 months.

- 59% of the respondents who are currently studying mentioned that the National Economy is better or much better compared to 12 months ago. Non surprising, respondents aged less than 24 years find the economy in better shape too.

- Respondents with an income below 15 million VND find the National Economy in better shape than 12 months ago compared to those with an income greater to 15 million VND.

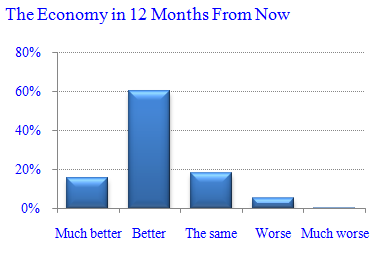

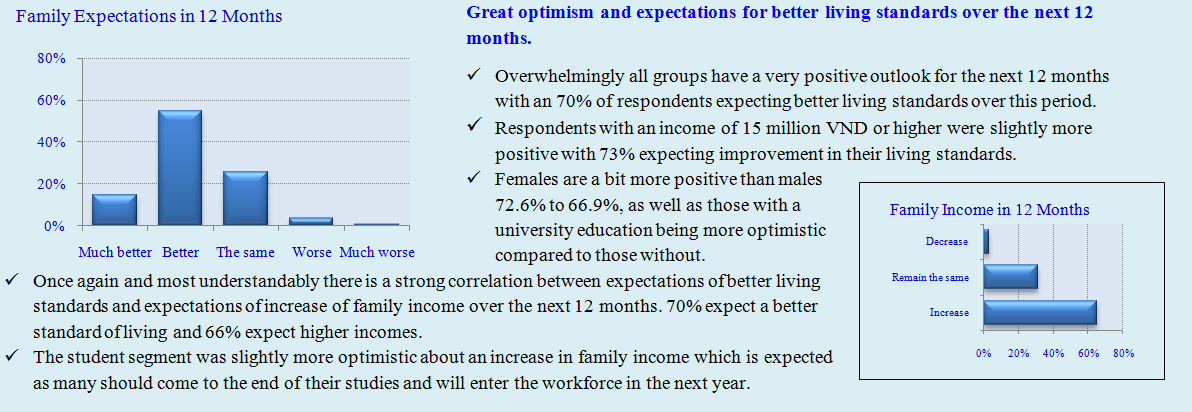

A positive outlook and great expectations over the next 12 months.

- Overwhelmingly respondents to the survey have a positive outlook for the National Economy. Over 75% of respondents expect that the National Economy will be better or much better in the next 12 months.

- Again the most optimistic group is young students of which over 80% have optimistic expectations for the year ahead.

RESPONDENT PROFILE

Huynh Thi Kieu is a typical 20 years old person living in Ho Chi Minh City, she sees a bright future for herself and those around her. She is a student at the Ho Chi Minh City College of Economics and as a Business Management Major she is optimistic and even confident about her future and in her ability to get a good job once she finishes school.

Kieu is young, trendy and even cosmopolitan which is different from the Hau Thanh Tay village in Long An province where she grew up. Kieu moved to Ho Chi Minh to study and now lives with her sister who has also moved to the city to further her education. She says her parents have a good and steady income working their rice farm and she also has a part-time job as a sales person in a mobile phone shop. Her salary is only 3 million VND + bonus a month (about $150). “Is not much, but it’s enough to cover all my living expenses and I can support my younger sister”.

Her optimism in the future is not simply based on her university studies, but also on what she sees around her, “I see people in Ho Chi Minh City that have a better standard of living and most of my friends and people around me have a good job”. Jobs and income are related she says and she knows is not always easy to get the job you want; “to get job in a big or small company even with a university education, you need to know someone inside that company that will introduce you and support you”. Many job seekers in Vietnam still adhere to this traditional way to get employment, and many new graduates from the best schools still seek for someone to ‘sponsor’ them into employment.

BUSINESS AND EMPLOYMENT

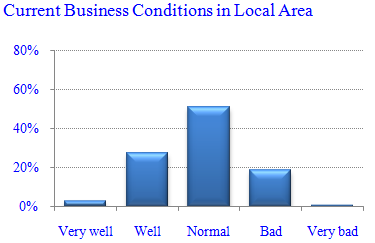

Average local business conditions.

- Those with a university education have a slightly more positive outlook of current local business conditions with 33% respondents with that level of education saying that local businesses were doing well or very well.

- In comparison only 26% of respondents without a university education had a similar view of current local business conditions.

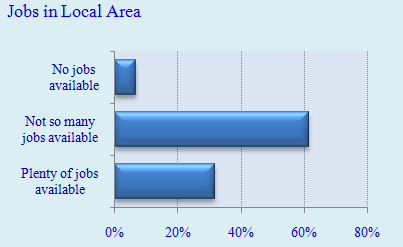

Not many jobs around at the moment

- Categorically respondents believe that there are ‘no jobs or not so many jobs available’ at the moment.

- 70% of survey respondents said that there we ‘no or not so many jobs available’ compared to 30% that said there were ‘plenty of jobs available’.

- The most positive of the groups of respondents are students with 35% saying that there were ‘plenty of jobs available’ at the moment.

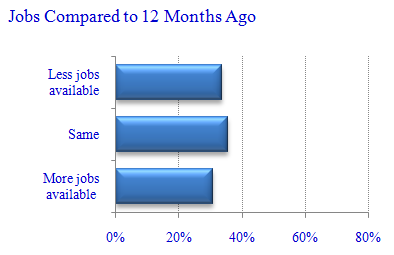

Divided views about number of jobs available compared to 12 months ago.

- Respondents for the most part evenly distributed their answers among the three answer options; ‘more jobs available’ – 31%, ‘same as 12 months ago’ – 35% and ‘less jobs available’ - 34%,

- The only respondent group with a more positive view of the current job situation compared to 12 months ago was the ‘students’. The improvement was very minor and arguably this is the group that was probably not looking for a job.

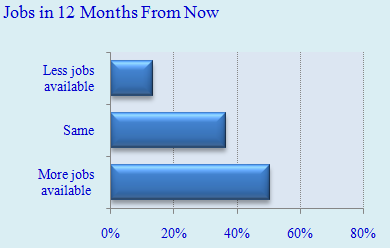

Great optimism on the job market for the next 12 months with 50% of overall respondents saying that they expected more jobs available at that time.

- Only 10% of respondents expect that there will be fewer jobs in 12 months compared to the present situation.

- Those with a university education are slightly more optimistic compared to other groups, with 54% mentioning that they expected to see more jobs available in the next 12 months. Only 45% of respondents without a university education had the same view.

- Males are a bit more optimistic compared to females (53% to 48%) and interestingly those with an income below 15 million VND are more positive with 53.5% compared to 44% of those with a family income equal or greater than 15 million VND per month.

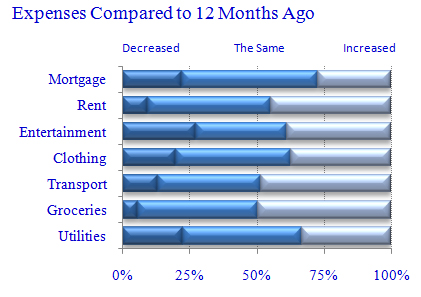

Living costs are a concern for young consumers.

- For all their optimism, young consumers do feel the pressure of an ever increasing cost of living. We measured the changes in 7 basic household items, ‘utilities, groceries, transport, clothing, entertainment, rent and mortgage’.

- Those under 25 are significantly more sensitive about price increases compared to the 25+ group 44% to 35%.

- Groceries with 49% are the main overall concern for young consumers. This is not uniform across the groups; students for example are much more concerned about rent prices (57%), transport (53%) and entertainment (48%).

- The group most concern about groceries are females who with 54% are significantly more sensitive to price increases compared to males 45%.

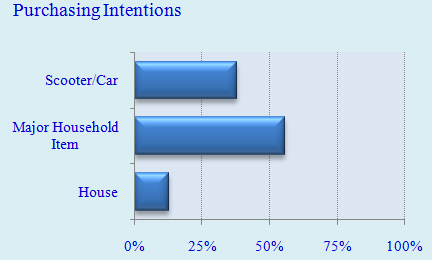

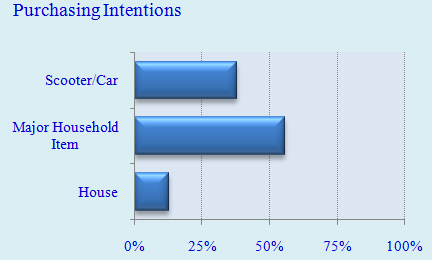

Favorable buying conditions among young consumers.

- Positive buying expectations for the year ahead, with major household goods such as furniture, kitchen appliances and televisions the most likely items to be sought after.

- The housing affordability expectation on the coming year is 12%, but that number goes up to 19% among the University educated, high income and over 25 Years of age respondents

- 37% of respondents mentioned that their family expected to buy a vehicle (a scooter most likely) in the next 12 months.

SPOTLIGHT QUESTION – BANKS

Vietnam has over 50 different banking institutions with differing forms of ownership, from State-Owned, Joint Stock Commercial and Foreign-Owned Banks. On This month feature topic we focused on general banking awareness, we asked respondents to name their TOP 3 banks, ranking them where 1 would mean that is the best Bank.

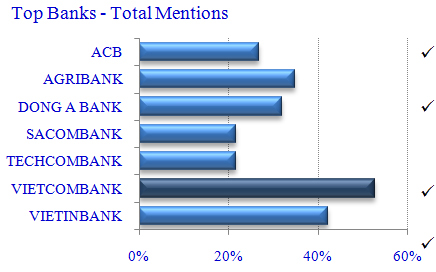

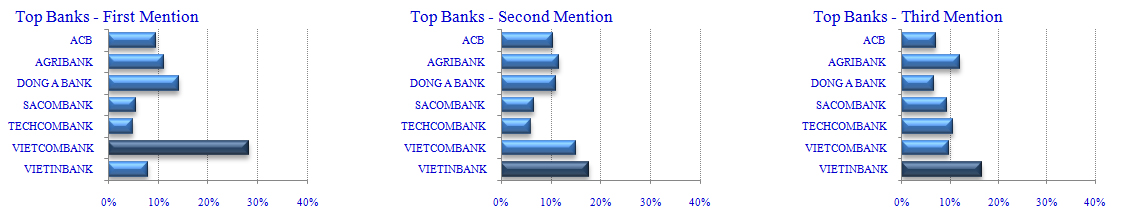

VietcomBank leads the way.

- All respondents segments ranked the VietcomBank as their top bank with 28% of first mention responses.

- The VietcomBank had and an overall 53% cumulative total response (1st, 2nd and 3rd responses). The highest cumulative response was given by respondents aged 25+ with 61%, while the lowest score was given by students with 39%.

- The VietinBank has an overall cumulative response of 41%, with students given it the highest overall cumulative score of 56%.

- The result for VietinBank is interesting because they received a low ‘first mention’ ranking, coming 5th with 8%, but it recovered strongly in second and third mentions to finish second overall.

- The AgriBank was also rated highly by the students who gave a cumulative score of 44%. AgriBank finished up third overall with a cumulative ranking (1st, 2nd and 3rd responses) of 35%.

- The Dong A Bank ranked second as a first mention response with 14%, and it ended up with a cumulative response of 32% in 4th place.

We wanted also to learn about the reasons young consumers chose a bank. We gave respondents a randomize list of potential answers and we ask them to rank the TOP 3 factors (where the first was the most important) they take into consideration when they select a Bank to use.

When thinking of Banks, is all about their reputation.

- Young consumers worry about the reputation (26%) of their financial institutions and that is the most important factor they take into consideration when choosing a Bank to use.

- Also important when choosing a bank is ATM accessibility with 16%, good Interest Rates 14% and the level of service provided 11%.

- For respondents with a better income having good interest rates was slightly more important than ATM accessibility while lower incomes and those under the age of 25 years find it slightly more important to have access to ATMs.

Tiếng Việt

Tiếng Việt.png) English

English

.png)